How China Beats the West in its Own Game

China's investment markets and infrastructural independence

Written by Chen Kojira.

Edited by Mak.

This article is the fifth part of RTSG’s series of articles exploring China and her economy, with previous articles covering China’s state-owned enterprises, China’s financial system and economic growth, and China’s corporate governance.

How exactly does China utilize its foreign investments? Many members of the “Left” have criticized the CPC for allowing foreign enterprises to operate in China, believing that the Party has somehow capitulated to the will of the Western oligarchs who run these companies. This article will provide insight into how China actually engages with foreign companies, uses their investments and foreign IP transfers for the purpose of moving up the industrial chain.

Technology exchange and Joint-Ventures

No better proof of the Russian Soviet Republic’s material and moral victory over the capitalists of the whole world can be found than the fact that the powers that took up arms against us because of our terror and our entire system have been compelled, against their will, to enter into trade relations with us in the knowledge that by so doing they are strengthening us. This might have been advanced as proof of the collapse of communism only if we had promised, with the forces of Russia alone, to transform the whole world, or had dreamed of doing so. However, we have never harbored such crazy ideas and have always said that our revolution will be victorious when it is supported by the workers of all lands. In fact, they went half-way in their support, for they weakened the hand raised against us, yet in doing so they were helping us.

Vladimir Lenin, Our Foreign and Domestic Position and Party Tasks - November 21, 1920.

First off, what is technology exchange? Technology exchange is the process of transferring technology from the person or organization that owns or holds it to a new owner. It is typically done to transform inventions and scientific outcomes into new products and services that benefit society.1

China uses this method to climb up the industrial-manufacturing ladder, which is getting foreign companies to transfer their technology in exchange for access to the Chinese market. Though many foreign companies complain, they generally acquiesce to this arrangement. China has an edge over other countries in this regard. For example, Malaysia has been unable to persuade any of its various foreign partners – most notably Mitsubishi – to transfer key technologies. The Chinese car companies have, one way or another, been rather more successful. The bargaining counter of size carries great clout; China has fifty times the population of Malaysia.2

These technology transfers typically take the form of joint-ventures, which is a combination of two or more parties that seek the development of a single enterprise or project for profit. This allows the Chinese party to gain access to the IP and technology rights offered by said enterprise.

A 2012 study found that international joint ventures in China contributed around 1% of China’s total GDP growth per annum. These enterprises are 23% more productive as compared to other firms. International joint venture companies and domestic companies who cooperate with international joint ventures both have a 73% productivity advantage over other companies. Hence we can say that the role that joint-ventures play in technology transfer assists in capital accumulation, capital deepening and increasing modernization of China’s productive forces.

How Technology Transfer is Utilized

In order to gain access to the vast and rapidly growing China market, Boeing was required to assist the main Chinese aircraft manufacturer in Xi’an. Specifically, Boeing had to successively establish the local capacity to produce spare parts both for Boeing’s commercial aircraft and Xi'an’s planes, then manufacture whole sections of aircraft and finally to assist in the development of a capacity to produce complete aircraft within China.3

In a similar vein, to gain the rights to invest in car production in China, Ford Motor Company was required to first invest 50 million USD over several years for the purpose of upgrading the technical capacity of the Chinese automobile spare parts industry through a sequence of joint ventures. In today’s money, that would be around 105 million USD.4

We can see that with just these two examples alone the transfer of technology transfers were used to improve and strengthen China’s domestic industrial capacity. This is not merely a hollowing out of the economy to accommodate foreign capitalists, but rather a way to use foreign capital to strengthen and develop the national economy.

This further exemplifies the Chinese policy and attitude towards foreign investments which is the following: “Import, digest, absorb and re-innovate” (引进消化吸收再创新). Utilizing foreign investments has always been used as a means to an end.

In the following sections I will present three case studies. Each example will cover a different technology in a different stage of maturation, developed to different degrees and their usage of foreign investments. The infancy stage, where foreign investments and technology still plays a large role and indigenous innovation is still in its beginning stage. In the intermediate stage, where both indigenous and foreign technologies alongside innovation are near parity with a slight edge given to indigenous technologies, and Chinese products are beginning to be more advanced and overtake non-Chinese products.

And the mature stage, where initially foreign investments and technologies were used but now domestic innovation built off the back of foreign technology is now much more advanced than the foreign nations technologies. With Chinese products being fully more advanced and have demonstrably overtaken non-Chinese products.

Case Study 1, Mature Stage: China’s high speed railway system

China’s high speed railway system is a good example to demonstrate a mature stage of Chinese technological usage of foreign investments. In 2004, the National Development Reform Commission and the Ministry of Railways were told to strengthen their guiding and coordinating capacities to modernize rolling stock production. To this end and for purposes of developing a Chinese national brand, China imported advanced technology, developed joint designs and got manufacturing help from foreign multinational companies.5

It should be noted that all aforementioned Chinese companies and factories are subsidiaries of Chinese state owned enterprises. Every single Chinese railway subsidiary enterprise is functionally owned by the CRRC (China Railway Rollingstock Corporation) operated under China’s railway bureau.6

Evidently this technology transfer worked. Between 2004 to 2015 there was a 42% increase in patents, of which 20% comes from railway related industries.7

Initially, Chinese indigenous production wasn’t able to close the gap between its railway manufacturing capabilities and those of foreign industry leaders (Japan, France, Germany etc.). The State Council did not consider domestic train models reliable enough for domestic usage, The State Council turned to advanced technology abroad but made clear in directives that China's HSR (high-speed railway) expansion could not only benefit foreign economies and should also be used to develop its own HSR building capacity through technology transfers.8

Since 2004, the Chinese government has begun public bidding for high speed railway.

On June 17 2004, "People's Railway" and the China Procurement and Tendering Network simultaneously issued a bidding announcement. The Ministry of Railways planned to purchase EMUs with a speed of 200 kilometers per hour, with a total of 10 packages of 200 trains, 2000 in total. The announcement clarified that the bidding subject is a domestic enterprise, but it must obtain the support of foreign advanced technology. Initially, the Ministry of Railways negotiated with Nippon Rolling Stock Corporation and Hitachi Manufacturing Co., Ltd., which own Shinkansen 700 and 800 series train technology, but both Nippon Rolling Stock and Hitachi stated that they refused to sell vehicles and transfer technology to China.9

Later, China switched to negotiating with Kawasaki Heavy Industries. At that time, Kawasaki Heavy Industries' sales performance was not as satisfactory as expected, so it sold three sets of E2 series trains and its vehicle technology to China. The move was initially opposed by JR East, Nikkei Motors and Hitachi. But after a round of negotiations, Kawasaki Heavy Industries sold E2 series vehicles and technology to China without objection from other Japanese companies.10

In October 2004, Kawasaki signed a contract with the Chinese Ministry of Railways to export railway vehicles and transfer technology on behalf of the "Japanese Enterprise Consortium". China has ordered 60 EMUs with a speed of 200 kilometers per hour from Japan's Kawasaki Heavy Industries, with a total value of 9.3 billion yuan (about 1.2 billion USD). Three of them were completed in Japan, and another six were delivered in parts and assembled by China.11

The remaining 51 trains were to be built by Qingdao Sifang Locomotive and Rolling Stock Factory through technology transfer. At that time, some high-tech components were still imported. In August 2005, the Ministry of Railways signed a technology transfer contract for electromechanical products for 51 CRH2A EMUs with six parties: Sifang Locomotive, Kawasaki Heavy Industries, Mitsubishi Electric, Zhuzhou Institute, Zhuzhou CSR Motor and Shijiazhuang Guoxiang Transportation Equipment.12

The first CRH2A was loaded from Kobe Port on March 1, 2006, and arrived in Qingdao on March 8. Among them, Siemens invited bids for Changchun rail buses and proposed to introduce the technology of "Villaro E". However, Siemens was unable to obtain any orders in the first round of bidding because of the high cost of transferring technology and vehicle construction.13

In 2005, Siemens participated in the second round of bidding. This time the conditions were even stricter. Due to its previous experience, Siemens was very cautious. In the end, it fully accepted China's technology transfer plan and price plan, cooperated with Tangshan Rail Passenger Cars, and produced CRH3 trains. China took advantage of its huge market and began to produce CRH1, CRH3 and CRH5 domestically through bidding and technology introduction. These two tenders enabled China's high-speed railway to open the market in exchange for technology and introduce advanced technologies from four companies. This laid the foundation for future localization.14

The Ministry of Railways evaluated and acquired all four existing HSR technologies from Canada, France, Germany and Japan respectively around 2008. Each foreign transferee was matched up with a domestic partner, initially under the auspices of satisfying the 75 percent localization rate, but with the eventual goal of training domestic custodians on the technologies once the transfer was completed. (p195, China as an innovation nation)

By 2011, the localization rate of train parts over 350 km/h reached 90%, with train parts that were 250 km/h hovering between 80 to 90%. In 2008, solely domestic enterprises only held 30% of the railway market – in 2011 it was 80%.15 By 2015, more than 90% of the railway market was controlled by the CRRC, formed through mergers of the pre-existing state owned railway enterprises which had a monopoly on the country.16

Kawasaki's cooperation with CSR lasted less than 2 years. The CSR began to build CRH2B, CRH2C and CRH2E models at its Sifang plant independently without assistance from its Japanese partner in 2008.17

Construction of the high-speed railway between Beijing and Shanghai, the world's first high-speed rail with a designed speed of 380 km/h (236 mph), began on April 18, 2008. The Ministry of Science and the MOR agreed to a joint action plan for the indigenous innovation of high-speed trains in China. A total of 400 new generation trains were ordered. The CRH380A/AL, the first indigenous high-speed train of the CRH series, entered service on the Shanghai-Hangzhou High-Speed Railway on October 26, 2010.18

After China began to introduce high speed rail in 2007, it only took a few years to transform foreign technology into independent research and development technology to the highest international level.19

The fastest commercial train service measured by peak operational speed is the Shanghai Maglev Train which can reach 431 km/h (268 mph).20

The fastest commercial train service measured by average train speed is the CRH express service on the Beijing–Shanghai high-speed railway, which reaches a top speed of 350 km/h (220 mph) and completes the 1,302 km (809 mi) journey between Shanghai Hongqiao and Beijing South, with two stops, in 4 hours and 24 min for an average speed of 291.9 km/h (181.4 mph), the fastest train service measured by average trip speed in the world.21

The CR400 “Fuxing” model solely designed and manufactured by China under the CRRC, first introduced in 2017, which are far more reliable and faster than the Japanese Shinkansen models. This is in comparison to the Hexie models of trains which are to be phased out within the next 10 years or so, which are made via joint-ventures and foreign technology transfers.22

One of the reasons why China ended up developing the Fuxing model is because China holds many patents related to the internal components of foreign train models, re-designed in China to allow the trains to run at higher speeds than the foreign designs allowed. However, these patents are only valid within China, and as such hold no international power. This weakness of Hexie trains’ intellectual property became an obstruction for China to export its high-speed rail related products due to protest from its foreign partners. This led to the development of a completely redesigned train brand, Fuxing, which is based on indigenous technologies.23

A 2019 study found that China's freight and passenger railway system ranks among the most efficient in the world. From an efficiency development perspective, the Chinese railway sector is beneficial and more balanced to be benchmarked as an example to be learned from compared to other significantly sized railway countries, like India or Russia.24

Subsequently, the fastest traditional EMU train is the CR400 “Fuxing” model, holding the number 2 spot behind the Chinese maglev out of the fastest trains in the world. (The 10 Fastest Trains in the World | Condé Nast Traveler) By 2021, the localization rate of the Chinese high speed rail way has reached 97%, with the remaining 3% being bearings. Though the first locally Chinese made bearing was completed in 2020, it is likely that by 2025 or 2026, the localization rate will reach 100%.25

In 2022, China also managed to develop its first permanent maglev suspension train – the Xingguo model which is entirely indigenously developed. This makes China the 3rd nation to have commercial “sky rails”, behind Germany and Japan.26

We can see that the dividends of the joint-venture system utilized by State Owned Railway enterprises cooperating with foreign enterprises initially has yielded great results. From becoming a net importer of high speed railway to becoming a world leader in it. All from using foreign technology to leap frog developmental gaps.

The high speed railway system in China is the “end result” that was born initially from foreign investments. As it matured to a level beyond Western railway industries, it discarded foreign investments in favor of indigenous innovation.

Case Study 2, Infancy Stage: Commercial Aircraft

The Commercial Aircraft would be a good demonstration of the infancy stage of Chinese technical usage of foreign investments. While there is some domestic innovation and technology, it has to be paired with foreign technology to maintain parity with non-Chinese commercial aircraft products.

As outlined in China’s 13th Five-Year Plan, China aims to implement policies that will build domestic capacity while “slowly closing market opportunities for U.S. companies in the United States and in third country markets in important high-tech sectors”. In this chapter we will be focusing on how this policy impacted the Chinese aerospace industry.27 As of 2021, roughly 60% of all Boeing planes in circulation have parts and assemblies manufactured in China. Since 1993, Boeing has invested in the training and professional development of Chinese aviation professionals by offering free training in pilot, maintenance, flight operations, and management techniques. In November 2009, it launched The Soaring With Your Dream programme to provide more enhanced, integrated training initiatives in China.2829

In 2014, Boeing and the state-owned aerospace and defense company, the Aviation Industry Corporation of China (AVIC), collaborated to establish a Manufacturing Innovation Center in one of the AVIC facilities that would provide training for AVIC employees on Boeing’s production methods in an effort to improve the employees manufacturing and technological capabilities. In 2015, Boeing and AVIC signed an agreement to improve AVIC’s manufacturing capabilities “by adding major component and assembly work packages, strengthening leadership, and developing AVIC’s broad aviation infrastructure and business practices, including supply chain management.”30

China’s strategy to its own commercial airline development can be summed up as “a strategy of first engaging in domestic production and assembly using foreign designs, then developing its own designs with foreign assistance, culminating in completely independent domestic development of a commercial aircraft without foreign assistance.”31

For example, China’s extensive involvement in the manufacturing of B737 parts and assembly of A320 for Airbus has improved its knowledge of single-aisle planes, eventually allowing China to produce and develop indigenous models.32

Offset agreements and joint ventures have had the greatest impact on aerospace technology transfer to China. In simple terms, industrial offset agreements transfer technology and/or production from a U.S. company to another country in return for a sale. These agreements typically include benefits such as subcontracting or worker training.33

The increase in composite material use within Boeing planes coincides with Boeing’s investment in the Chinese composite industry. Boeing has invested in Boeing Tianjin Composite Co. Ltd (BTC), through a joint venture with AVIC, which is responsible for manufacturing composite structures for Boeing airplanes.34 In 2011, China acquired Western avionics technology through Aviage Systems, a 50/50 joint venture between AVIC and GE. GE Avionics, it should be noted, provided the common core avionics system for the Boeing 787.35

A large portion of the C919 airliner still uses a sizable amount of foreign technology. The localization rate of the C919 is only around 60% and it’s the first proper “domestic aircraft” in China that has been deemed a success and has been on sale domestically.36

Of course, the C919 itself is not as good in terms of on paper specs compared to the aircraft duopoly such as the Airbus’s models.37 However it is still in its “infancy” stage, and if trends other industries are anything to judge, it wouldn't be a stretch to say that COMAC's commercial airliners will catch up and eventually surpass Boeing and Airbus.

Case Study 3, Intermediate Stage: Automobiles

The Chinese struggle to develop world class automobiles is a long one, but has now sufficiently been reached an intermediate stage of indigenous development. Where developments in indigenous automobile technologies have begun to be able to challenge and be technologically on par with the largest multinational automobile corporations.

In April 1986, the 7th five year plan officially proposed: "To consider the automobile manufacturing industry as a crucial pillar industry." The designation of a critical pillar industry was to highlight the necessity to drive rapid industry growth, enhancing international competitiveness, and promoting technological innovation in the automobile industry.38

The majority of automobile enterprises that are foreign are Sino-foreign joint ventures where state owned enterprises are partnering with foreign automobile companies for the purpose of gaining access to their technology and methods in return for market access while having a state owned firm onboard as a partner to maintain some degree of state control over the distribution of vehicles.

Throughout the 1980s to early 2000s, the basic automobile policy of joint-ventures was realized as such, the government has eagerly and successfully promoted joint ventures. However, prohibited auto plants from being fully owned by foreign carmakers in order to achieve the desired technology transfer.

Almost all international partnerships that were centrally supported were with the ‘Big Three, Small Three & Mini Two’ companies, while some locally or regionally supported small enterprises also engaged in license agreements with international automakers. Small enterprises generally rely on international automakers as they lack know-how for product development and sophisticated production management and commonly produce old Western and Japanese designs.39

Officially, since 2001 China is prohibited to demand technology transfers, but that didn’t decrease China’s desire to do so anyway. In the 80s and 90s, foreign auto companies were only giving away obsolete technology. But due to the large size of the Chinese market, many voluntarily handed over their more advanced models for a chance to gain market access by the turn of the 21st century.40

Some joint-ventures succeed while others fail. BAIC had a localization rate of 61% in the late 80s. By 2002, the localization of parts had jumped to 90%. In 2007 Daimler sold Chrysler to Cerberus. Since then Cherokee was no longer going to be made in China. But in early 2011 BAIC introduced a new SUV named Qishi, which was a redeveloped model of the Jump Cherokee Jeep. In 2010, BAIC’s first self branded sedan was based off of Daimler’s Mercedes Benz B class. Of course, there are other means of purchasing equipment (for example by buying out bankrupt companies such as the Swedish Saab automobiles which went bankrupt in 2009). BAIC’s first self-developed medium-to-high-end model car, called Senova, which was built off of Saab’s technology transfers.41

FAW-Volkswagen is another successful joint-venture which acquired advanced technologies and equipment to manufacture some of the world’s most famous models: Passat CC, Jetta, Bora, Golf, Caddy, Sagitar and various Audis. Initially, Germans were shipping their knock down kits from Germany to their factories in China to train Chinese engineers how to assemble them. In one instance this was done with over 900 models of VW Santanas. Moreover, eight Chinese workers were sent to Germany for advanced training. By 2011, VW’s electric vehicles were assembled and sourced locally from China, the E-Golf and E-Lavida. By the turn of the 2020s, VW has pledged to bring the latest, most innovative and environmentally friendly technologies to China in combination with the construction of new plants with the aim to boost the capacity of sales to 3 million cars in the following several years.42

The transfer of technology was not necessarily always smooth due to complaints from foreign partners. The training provided by foreign partners has improved the quality of Chinese automobile engineers, improved the quality of automobile part suppliers, domestic sources and facilitated the transfer of knowledge.43

A 2020 study found that knowledge spillover due to ownership affiliation, in addition to any industry-wide knowledge spillover, improved the quality of affiliated indigenous domestic models by 3.8-12.7% and raised their profits by 1.0-3.5% between 2007 and 2014.44

Malfunction rates of car models produced by domestic automakers fell by more than 75% from 2001 to 2014, demonstrating impressive quality improvement. At the same time, the quality gap between domestic models and JV models produced in China narrowed greatly; while the malfunction rate of domestic models was 65% higher than that of JV models in 2001, by 2014 this gap had shrunk to 33%. This is corroborated by the fact JV models typically score 1 standard deviation higher on quality dimensions while indigenous models affiliated with the JV score 0.087 standard deviations higher than solely domestic models.45

The study also found that joint ventures with foreign automakers didn’t just improve Chinese-made cars. They also improved each Chinese automaker’s cars in the areas where the foreign partner was proficient in. Chinese automakers that partnered with Japanese brands tended to be more fuel-efficient. Chinese automakers that partnered with German brands tended to have stronger engine performance.46

The worker flow from the joint-venture to affiliated domestic models contributed to around 54% of the total knowledge spillover, and this increases with the flow of technicians from JVs to domestic automakers. Furthermore, the flow of skilled workers benefits both affiliated and unaffiliated domestic firms.47

When we factor in cumulative learning, the positive effect of the knowledge transfer to joint-ventures amounts to a 19.5% improvement (around 24 fewer defects per model) for affiliated models and a 12.7% improvement for all domestic models.48

Another good case study in the NEV (New Electronic Vehicle) industry would be Tesla. China agreed to make special concessions to convince Tesla to build a plant in China. China changed its rules to allow the Shanghai Gigafactory to be a wholly owned foreign subsidiary rather than a joint venture with a Chinese firm, as was previously required for all foreign automakers. Tesla is a catfish that turns Chinese EV makers into sharks. Tesla’s Shanghai factory bought 86 percent of outsourced Model 3 and Model Y components within China in the fourth quarter of 2020, compared with 73 percent for Tesla cars made in its California factory.

In return for Tesla’s access, Tesla sold the Gigacasting manufacturing process (which greatly reduces the time and cost to produce an automobile) to LK Group (It’s Chinese supplier of automobile components) which in turn sold the gigacasting rights to 6 other Chinese automobile companies.49

Of course, not just automobile suppliers benefited. Chinese battery suppliers, making up 40% of Tesla’s batteries and 39% of the world share, also did.50 CATL and Tesla are cooperating together to produce high quality batteries for EVs.51

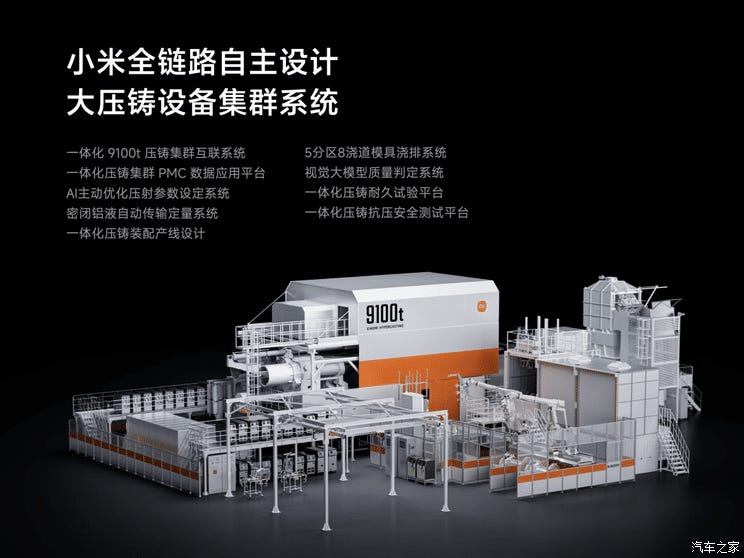

Now we see the beginning of Chinese automobile tech starting to outstrip the west. With NIO ET7’s debut with a NEV that has the world’s first semi solid-state battery powered car, that has a maximum range of 1,040 km/646 miles.52 Xiaomi’s new car, the SU7 is a NEV Sedan produced in partnership with state owned automobile manufacturer, BAIC.53 The factories that produce these sedans are capable of making 1 SU7 every 76 seconds, thanks in part to the gigacasting technology sold by Tesla to Chinese automakers.54

And recently in May of 2024, BYD released a new hybrid which had a maximum range of 2,000km/1242 miles. The total cost of which is 13,800 USD. The longer range means some of BYD’s dual-mode plug-in electric hybrid cars can cover the equivalent of Singapore to Bangkok, New York to Miami or Munich to Madrid on a single charge and a full tank of gas.55

We see that China’s automobile industry is reaping the fruits of its development model. It is now in its intermediate stage which means that its technology is beginning to outstrip foreign competitors and it can maintain parity with these industries. While I am doubtful China will be able to reach such a dominant or monopolistic position with automobiles like in the high speed railway industry, it will most definitely keep developing to become an ever stronger contender in the industry.

Conclusion

In short, the Chinese method of utilizing foreign investments, dictating them to fulfill 5YPs and Chinese government mandates, has been successful. In all aforementioned case studies, each at a different developmental stage of maturation, foreign investments have assisted China in developing its own indigenous world-class industries. Objectively, the utilization of foreign investment from the First World has helped accelerate the development of the productive forces in China, allowing it to compete with the developed world.

When China Rules The World: The Rise of the Middle Kingdom and the End of the Western World, p174

Financial Times, 9 August 1994

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

Ibid.

The Effectiveness of China’s Industrial Policies in Commercial Aviation Manufacturing Rand Corp., 2014, p12

A. MacPherson and D. Pritchard, “The International Decentralization of US Commercial Aircraft Production: Implications for US Employment and Trade”

C. Ohlandt, L. Morris, J. Thompson, A. Chan, and A. Scobell, Chinese Investment in U.S. Aviation, Rand Corp., 2017.

Ibid., p16

Ibid., p19-20

Ibid., p20-22

Ibid., p24-25

Ibid., p6

Ibid., p17

Ibid., p24

Ibid., p26